Stay up to date with our latest news and insights

Supporting description on the types of content that feature in the blog.

Bad cash flow management can be very damaging for a business. So much so that it’s not unusual for a business to collapse due to outstanding debtors and not enough money coming into the business at the right time.

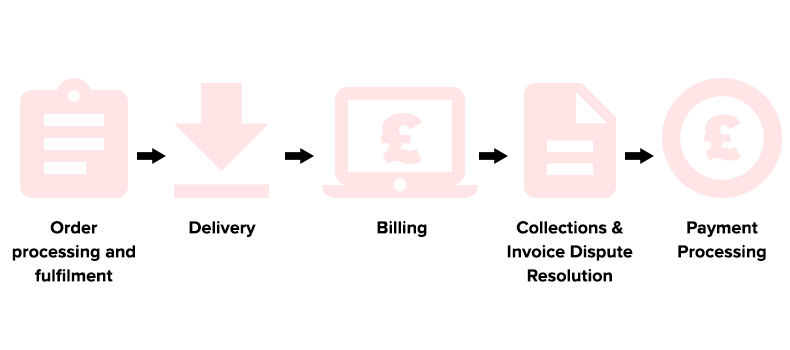

Accounts receivable (AR) is a big part of keeping company finances on track through the various processes involved from generating and sending out invoices to maintaining records of payments and general accounting functions.

It can be a time-consuming financial job made more difficult by debtors with late payments, short payments, out-of-date discount claims, contract disputes and of course, unrecoverable debt. All of these challenges add to the workload of the finance team, who already have a lot on their plate.

Further still, having large amounts of unallocated cash and open items reduces the visibility that the finance team has and makes the month-end a challenge.

Although a complex and time-consuming process, it’s vital to the business that accounts receivable processes are done correctly and accurately to please all parties involved including the company collecting the money and the company or entity paying the money.

In an attempt to reduce complexities in AR processes, we considered whether accounts receivable processes could be digitised and even automated.

Yes! And not only can AR processes be automated, they can be made more efficient!

Let’s start with three key reasons that you might choose to automate accounts receivable processes:

They’re good reasons to consider automation and all have great benefits for the business as a whole.

Automating AR processes doesn’t just rely on digitisation of documents but can actually be done for the delivery of both paper and electronic invoices to customers, so those that have not gone paperless will still be able to work with the new system, while those demanding e-invoices will be satisfied.

When order forms or purchase orders come into the finance team, the automated process captures the documents, validates the information and delivers it to the organisation's back-end systems.

As payments come into the organisation, they are automatically captured, identified and data is extracted from remittances, checks and other relevant documents. All the data and information is then validated, balancing remittance totals against check amounts and reconciling payments with open invoices.

Once all of this is done, accounting systems are automatically updated.

As well as the key reasons mentioned above, some of the other benefits of automating accounts receivable processes include:

You can learn more about intelligent automation, robotics process automation, Ai Capture and other intelligent workplace services here.

Supporting description on the types of content that feature in the blog.

20-09-2024

Digital document management tools offer a range of compelling benefits for businesses, including a PDF editor, a file converter and a form generator. You can also integrate with digital signatures qui...

20-09-2024

When choosing a SaaS software to deal with your company’s PDF documents and enable forms to be digitally sent and signed, you’ll want a product that’s user-friendly and easy to use. With Tungsten’s Po...

11-07-2024

Belkin is a global technology company that provides high-quality electronics products, from wireless chargers to power banks. Their people-centric approach and best-in-class functionality have positio...